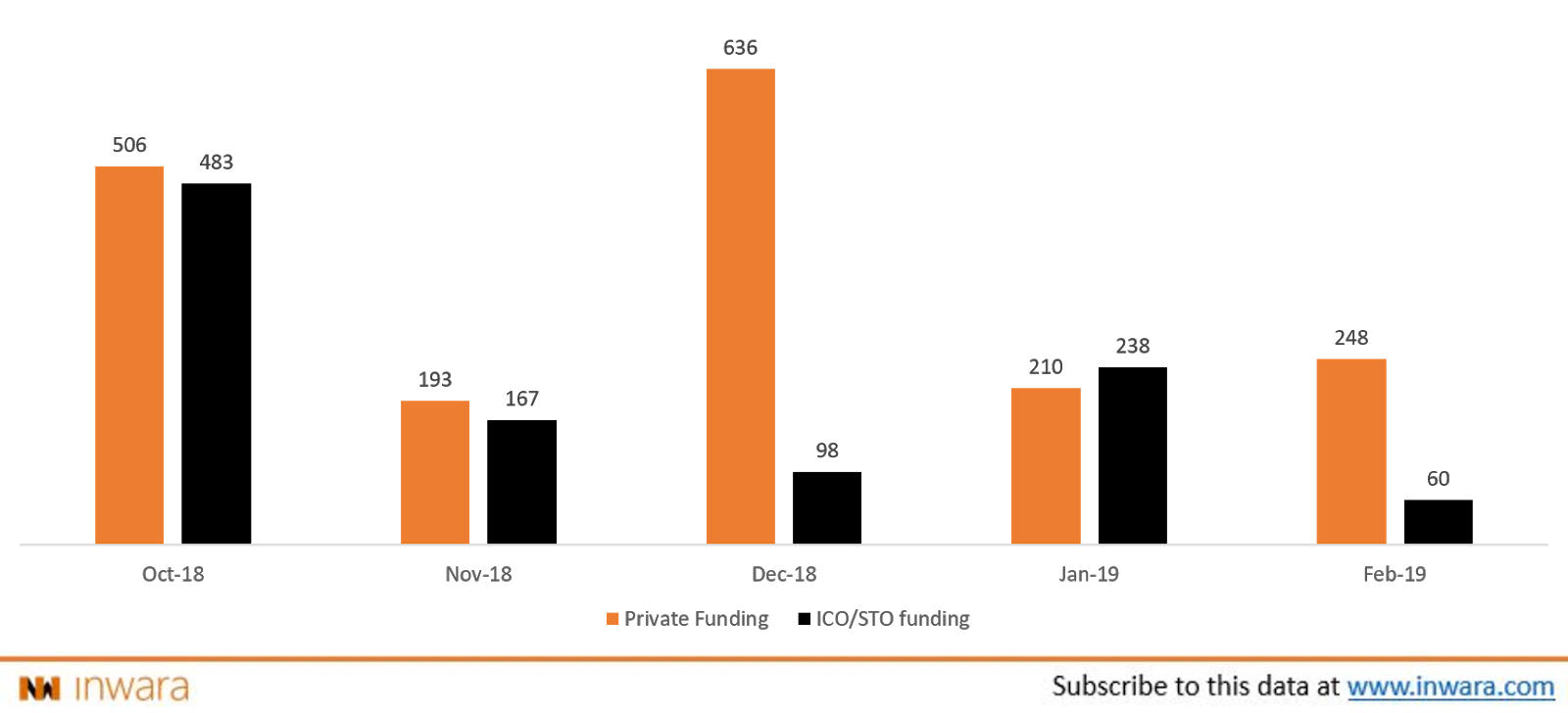

The funds raised by American startups through Initial Coin Offerings amounted to a measly $1.5 million, during the month of February 2019. In the same time period, funds raised by blockchain and crypto startups from private investors amounted to a whopping $248 million, an 18% increase from the previous month (Source). Is this just a random anomaly? Or could these developments be a precursor to a much broader shift in market perspective? Let’s deconstruct the events that led up to this shift in perspective in the blockchain and crypto community.

The rise and fall of ICOs in the US

It’s nearly been a decade since the advent of blockchain technology and the promise to revolutionize the financial ecosystem. Now, blockchain technology is poised to revolutionize, not just the financial sector but almost every industry sector imaginable from Healthcare to Gaming. Blockchain developers found several use cases for the technology in numerous sectors but arguably, the most profound application came from cash-starved entrepreneurs looking to get their projects off the ground.

Enter Initial Coin Offerings! ICOs enabled entrepreneurs to raise capital on a global scale through crowd sales, which meant virtually anyone with an internet connection could invest in their projects. And this model of fundraising was so disruptive that startups managed to raise as much as $ 6 billion in 2017 and the number of ICOs world over swiftly skyrocketed.

But Initial Coin Offerings in the US plummeted just as quickly as their rise to fame. The Securities and Exchange commission classified ICOs as an ‘unregulated security’, prompted by the numerous ICO scams prevalent in the space, which inadvertently caused ICO numbers to dwindle. For example, Airfox an American startup that aimed to revolutionize the telecommunications space in developing nations by leveraging blockchain technology was charged by the SEC with a cease and desist order. This order was a result of Airfox’s ICO clearing the Howey test, meaning it qualifies as a ‘financial security’.

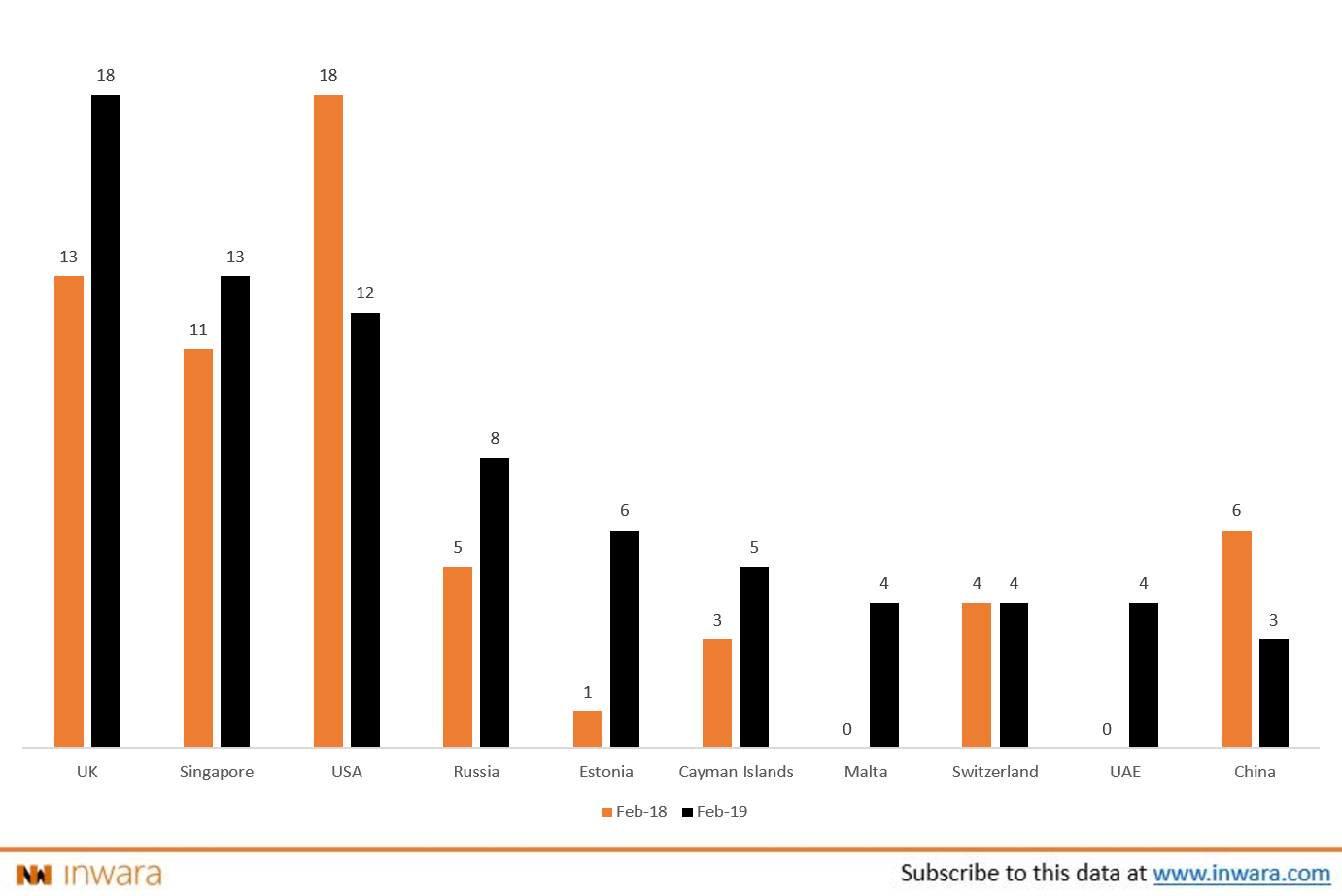

While regulators cracked down on ICOs in the US, other countries like the UK and Singapore welcomed ICOs by setting up a regulatory framework that is conducive for their success.

# of ICOs, country-wise

Source

In light of the favorable regulatory environment prevalent in the US the number of ICOs during the month of February dropped by as much as ~34%, while almost every other country observed positive growth. For example, new players to the space like Estonia witnessed a 400% increase while the UK witnessed a 38% increase in the number of ICOs. China is the only other country, other than the US, to witness negative growth in the number of ICOs this month and is likely because of The People’s Bank of China outright banning ICOs.

So why shift towards private funding?

The answer to this question is simple, American startups often find it easier to raise capital from private investors rather than traversing across the regulatory minefield that is a public Initial Coin Offering. On top of this, raising capital from private investors could be beneficial to startups looking to get their project off the ground, as investors can often leverage their professional network to help the company grow swiftly.

Analysing the data for funds raised through private investments and public ICO could provide conclusive evidence for this shift in perspective.

Funds raised ($MM) through private funding and ICO sales

Source

Capital raised by startups through private investments amounted a whopping $1.788 billion, which is 71% higher than funds raised through public ICOs.In retrospect, this wasn’t always the case in the ICO space, as public sales often raised inordinate sums of money like with the case of EOS which attracted almost $4 billion during its ICO.

Inadvertent consequences

As startups, forced by regulatory authorities, start to favor private accredited investors over retail investors, ICOs could become more exclusive and may even loose it’s empowering grassroots allure which fueled its popularity in the first place. Venture Capital firms especially are now zeroing in on a new type of token offering, one that is compliant with regulatory norms. Security Token Offerings or an STO is very similar to an ICO, in the sense that both offer investors tokens in exchange for capital but STO also offer investors rights over the tangible rights of the company, which is radically new in the crypto space. For example, Polymath is a security token issuance platform that facilitates the launch of regulatory compliant token offerings. On top of this, STOs also creates a conducive environment for tokenizing real-world assets like Real Estate, which suffers from low-liquidity in the market.

Even though current developments stack the odds against retail investors, it needn’t be a cause for worry as there is one aspect of blockchain that makes excluding the people impossible. A blockchain network, due to its inherently decentralized nature, requires people in the form of users, developers, miners among other roles, to keep the network functioning. On top of ICOs acting as a fundraising tool, they also double as a token distribution channel for garnering more users to the company’s platform. It can be considered as a mutually beneficial relationship as users are incentivized to join a company’s platform using tokens and by virtue of the network effect, this means the value of the blockchain network also increases.

The post Why American startups are swaying towards private funding over ICOs appeared first on Cryptoverze.